Useful links to help you understand logistics better.

Mavyn is a technology-driven logistics company that focuses on truckload (more than 800 km) transportation in India. It is backed by Chetak Group, who are pioneered in logistics industry in India. Mavyn is the first internet company in India to apply Artificial Intelligence (AI) and big data in the truckload logistics sector.

A Third party logistics providers typically specialize in integrated operation warehousing and transportation services that can be scaled and customized to customers' needs based on market conditions and the demands and delivery service requirements for their products and materials. Often, these services go beyond logistics and included value-added services related to the production or procurement of goods, i.e., services that integrate parts of the supply chain. Then the provider is called third-party supply chain management provider (3PSCM) or supply chain management service provider (SCMSP).

There are two primary kinds of Third-Party Logistics (3PL) Providers: Asset based and non-asset based. An asset-based provider can be a warehouse company, for example, that manages all or part of a client's logistics operations. In such a case, the 3PL provides physical assets and labor resources to perform the required services. Clients using this kind of 3PL generally must use the limited assets of these companies.

Business Logistics is a non-asset based 3PL. We customize programs to meet each client's specifications and have the flexibility to move to different providers and our clients needs change over time.

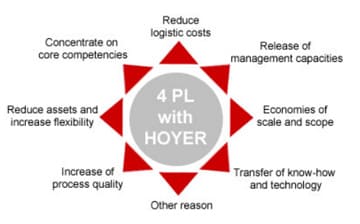

Arrangement in which a firm contracts outsources its logistics operations to two or more specialist firms (3PL) and hires another specialist firm (4PL) to coordinate the activities of the 3PL.

A 4PL is neutral and will manage the logistics process, regardless of what carriers, forwarders, or warehouses are used. The 4PL can and will even manage 3PLs that the customer is already currently using. Many 4PLs have addressed the huge requirements of electronic interface between numerous companies. Companies like JDA, GT Nexus, Chetak Logistics provides specific capabilities in electronic data interchange (EDI), electronic funds transfer (EFT).

Now a new crop of companies have emerged who are actual transportation companies too. While a 4PL is sometimes described as non-asset-owning service provider, their role is to provide broader scope managing of the entire supply chain.

An emerging sub sector is the 5PL firm attributed to logistics service providers who plan, organize and implement logistics solutions on behalf of a contracting party (mainly information systems) by exploiting the appropriate.

GENCHI – Actual Place

GENBUTSU – Actual Thing

GENJITSU – Actuallli

KIMERAARETA KOTO GA – What has been decided

KIHON DIRI – As per the standard

KICHIN TO MAMORU – Must be followed

MURI – Inconvenienance

MUDA – Wastage

MURA - Inconistency

Reduce

Reuse

Recycle

Man

Machine

Material

Method

SEIRI - Proper Selection

SEITIO - Arrangement

SEISO - Cleaning

SEIKETSO - Cleanliness

SHITSUKE - Disipline

All Risks Coverage, a type of marine insurance, is the broadest kind of standard coverage, but excludes damage caused by war, strikes, and riots.

A phrase referring to the side of a ship. Goods to be delivered alongside are to be placed on the dock or lighter within reach of the transport ship's tackle so that they can be loaded aboard the ship. Goods are delivered to the port of embarkation, but without loading fees.

A symbol consisting of a series of printed bars representing values. A system of optical character reading, scanning, tracking of units by reading a series of printed bars for translation into a numeric or alphanumeric identification code. A popular example is the UPC code used on retail packaging.

A device to read bar codes and communicate data to computer systems.

The cargo-carrying vehicle which may or may not have its own propulsion mechanism for the purpose of transporting goods. Primarily used by Inland water carriers, basic barges have open tops, but there are covered barges for both dry and liquid cargoes.

Bills of lading are contracts between the owner of the goods and the carrier. There are two types. A straight bill of lading is nonnegotiable. A negotiable or shipper's order bill of lading can be bought, sold, or traded while goods are in transit and is used for many types of financing transactions. The customer usually needs the original or a copy as proof of ownership to take possession of the goods.

The Customs Service authorises bonded warehouses for storage or manufacture of goods on which payment of duties is deferred until the goods enter the Customs Territory. The goods are not subject to duties if reshipped to foreign points.

The separation of a consolidated bulk load into smaller individual shipments for delivery to the ultimate consignee. The freight may be moved intact inside the trailer, or it may be interchanged and rehandled to connecting carriers.

Cargo that is shipped as a unit or package (for example: palletized cargo, boxed cargo, large machinery, trucks) but is not containerized.

A vessel designed to handle break bulk cargo.

The practice of outsourcing non-core internal functions to third parties. Functions typically outsourced include logistics, accounts payable, accounts receivable, payroll, and human resources. Other areas can include IT development or complete management of the IT functions of the enterprise.

The fundamental rethinking and radical redesign of business processes to achieve dramatic organizational improvements.

As opposed to business-to-consumer (B2C). Many companies are now focusing on this strategy, and their web sites are aimed at businesses (think wholesale) and only other businesses can access or buy products on the site. Internet analysts predict this will be the biggest sector on the web.

The hundreds of e-commerce web sites that sell goods directly to consumers are considered B2C. This distinction is important when comparing web sites that are B2B as the entire business model, strategy, execution, and fulfillment is different.

A customs document permitting the holder to carry or send merchandise temporarily into certain foreign countries for display, domonstration or other purposes without paying import duties or posting bonds.

Total Inventory Days of Supply + Days of Sales Outstanding - Average Payment Period for Material in Days.

A method of payment for goods in which documents transferring title are given to the buyer upon payment of cash to an intermediary acting for the seller.

In retailing, the length of time between the sale of products and the cash payments for a company's resources. 2) In manufacturing, the length of time from the purchase of raw materials to the collection of accounts receivable from customers for the sale of products or services.

A method of payment for goods whereby the buyer pays the seller in advance of shipment of goods.

The time it takes for cash to flow back into a company after it has been spent for raw materials. Synonym: Cash Conversion Cycle.

A method of payment for goods where cash is paid at the time of order, and the transaction becomes binding on both buyer and seller.

A receipt for goods issued by a carrier with an indication that the goods were received in apparent good order and condition, without damages or other irregularities.

The commercial invoice is a bill for the goods from the seller to the buyer. These invoices are often used by governments to determine the true value of goods for the assessment of customs duties and are also used to prepare consular documentation. Governments using the commercial invoice to control imports often specify its form, content, number of copies, language to be used, and other characteristics.

The person or firm named in a freight contract to whom goods have been consigned or turned over. For export control purposes, the documentation differentiates between an intermediate consignee and an ultimate consignee.

Delivery of merchandise from an exporter (the consignor) to an agent (the consignee) under agreement that the agent sell the merchandise for the account of the exporter. The consignor retains title to the goods until sold. The consignee sells the goods for commission and remits the net proceeds to the consignor.

The location designated by carriers for receipt of cargo to be packed into containers/equipment by the carrier. At destination, CFS is the location designated by the carrier for unpacking of cargo from equipment/containers.

The seller quotes a price that includes the cost of transportation to a specific point. The buyer assumes responsibility for loss and damage and pays for the insurance of the shipment.

The cost to borrow or invest capital.

The amount of direct materials, direct labor, and allocated overhead associated with products sold during a given period of time, determined in accordance with Generally Accepted Accounting Principles (GAAP).

Cost, insurance, and freight (CIF) to a named overseas port of import. Under this term, the seller quotes a price for the goods (including insurance), all transportation, and miscellaneous charges to the point of debarkation for the vessel. (Typically used for ocean shipments only. CIP, or carriage and insurance paid to, is a term used for shipment by modes other than water.)

A freight surcharge or adjustment factor imposed by an international carrier to offset foreign currency fluctuations. In some cases an emergency currency adjustment factor (ECAF) may be applied when a charge or rate has been originally published in a currency that is experiencing sustained or rapid decline. The CAF is charged as a percentage of the freight.

This refers to information systems that help sales and marketing functions as opposed to the ERP (Enterprise Resource Planning), which is for back-end integration.

A Canada Customs system that allows for the electronic transmission of import data for goods that have already been released. Additional information such as accounting data and release notifications are also accessible.

While the term "Ex Works" signifies the seller's minimum obligation, the term "DDP - Deliver Duty Paid", when followed by words naming the buyer's premises, denotes the other extreme -- the seller's maximum obligation. The term "Deliver Duty Paid" may be used irrespective of the mode of transport. If the parties wish that the seller should clear the goods for import but that some of the cost payable upon the import of the goods should be excluded -- such as value added tax (GST) and/or other similar taxes -- this should be made clear by adding words to this effect (e.g., "exclusive of GST and/or taxes").

Deliver Duty Unpaid, referring to DDP except buyer pays for the import duty.

Provides specific information to the inland carrier concerning the arrangement made by the forwarder to deliver the merchandise to the particular pier or steamship line. Not to be confused with Delivery Order which is used for import cargo.

Excess time taken for loading or unloading a vessel, thus causing delay of scheduled departure. Demurrage refers only to situations in which the charter or shipper, rather than the vessel's operator, is at fault.

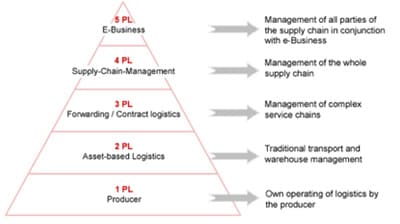

A first-party logistics provider (1PL) is a firm or an individual that needs to have cargo, freight, goods, produce or merchandise transported from a point A to a point B. The term first-party logistics provider stands both for the cargo sender and for the cargo receiver.

A 1PL can be a manufacturer, trader, importer/exporter, wholesaler, retailer or distributor in the international commerce field. It can also be institutions such a government department or an individual or family removing from one place to another.

Anyone having goods moved from their place of origin to their new place is considered to be first party logistics provider.

A second-party logistics provider (2PL) is an asset-based carrier, which actually owns the means of transportation. Typical 2PLs would be shipping lines which own, lease or charter their ships; airlines which own, lease or charter their planes and truck companies which own or lease their trucks.

A third-party logistics provider (3PL) provides outsourced or 'third party' logistics services to companies for part or sometimes all of their supply chain management function. Well known 3PLs include DHL, Wincanton, Norbert-Dentressangle, CEVA & NYK Logistics.

A fourth-party logistics provider (4PL) is an independent, singularly accountable, non-asset based integrator who will assemble the resources, capabilities and technology of its own organisation and other organisations, incuding 3PLs, to design, build and run comprehensive supply chain solutions for clients.

A fifth party logistics provider (5PL) will aggregate the demands of the 3PL and others into bulk volume for negotiating more favourable rates with airlines and shipping companies. Non asset based, it will work seamlessly across all disciplines. The central ethos of 5PL is its commitment to collaboration and to obtaining a higher degree of resource utilisation in order to achieve savings and open up opportunities to secure the best possible solution at minimum cost/carbon etc.,

The warehouse facility which holds inventory from manufacturing pending distribution to the appropriate stores.

A tax imposed on imports by the customs authority of a country. Duties are generally based on the value of the goods (ad valorem duties), some other factors such as weight or quantity (specific duties), or a combination of value and other factors (compound duties).

An area where goods or cargo can be stored without paying import customs duties while awaiting manufacturing or future transport.

Intercompany, computer-to-computer transmission of business information in a standard format. For EDI purists, computer to computer means direct transmission from the originating application program to the receiving or processing application program. An EDI transmission consists only of business data, not any accompanying verbiage or free-form messages. Purists might also contend that a standard format is one that is approved by a national or international standards organization, as opposed to formats developed by industry groups or companies.

A term of sale in which for the quoted price, the seller merely makes the goods avaliable to the buyer at the seller's "named place" of business. This trade term places the greatest responsibility on the buyer and minimum obligations on the seller. The Ex Works term is often used when making an initial quotation for the sale of goods without any costs included.

The FMC is an independent agency which regulates ocean borne transportation in the foreign commerce and in the domestic offshore trade of the United States.

Especially for heavy loads and over-dimensional cargo. Containers do not have sides or a top. This allows easy fork-lift and crane access.

Free Alongside Ship, FAS, at a named port of export. Under FAS, the seller quotes a price for the goods that includes charges for delivery of the goods alongside a vessel at the port of departure. The seller handles the cost of unloading and wharfage; loading, ocean transportation, and insurance are left to the buyer. FAS is also a method of export and import valuation.

Free Carrier, FCA, to a named place. This term replaces the former "FOB named inland port" to designate the seller's responsibility for the cost of loading goods at the named shipping point. It may be used for multimodal transport, container stations, and any mode of transport, including air.

Common price term used in international trade meaning seller's responsible for the cost of goods is to the point of loading it to the vessel deck or aircraft loading deck. The risk of loss of or damage to the goods is transferred from the seller to the buyer when the goods have been so delivered. FOB normally comes with port of loading either airport or sea port.

FAK is a shipping classification. Goods classified FAK are usually charged higher rates than those marked with a specific classification and are frequently in a container which includes various classes of cargo.

The grouping of shipments to obtain reduced costs or improved utilization of the transportation function. Consolidation can occur by market area grouping, grouping according to scheduled deliveries, or using third party pooling services such as public warehouses and freight forwarders. Freight Forwarder: An organization which provides logistics services as an intermediary between the shipper and the carrier, typically on international shipments. Freight forwarders provide the ability to respond quickly and efficiently to changing customer and consumer demands and international shipping (import/export) requirements.

Like C & F, "Freight/Carriage paid to ..." means that the seller pays the freight for the carriage of the goods to the named destination. However, the risk of loss of or damage to the goods, as well as of any cost increases, is transferred from the seller to the buyer when the goods have been delivered into the custody of the first carrier and not at the ship's rail. The term can be used for all modes of transport including multi-modal operations and container or "roll on-roll off" traffic by trailer and ferries. When the seller has to furnish a bill of lading, waybill or carrier's receipt, he duly fulfills this obligation by presenting such a document issued by the person with whom he has contracted for carriage to the named destination.

This term is the same as "Freight/Carriage Paid to ..." but with the addition that the seller has to procure transport insurance against the risk of loss of damage to the goods during the carriage. The seller contracts with the insurer and pays the insurance premium.

An independent business which handles export shipments for compensation. At the request of the shipper, the forwarder makes the actual arrangements and provides the necessary services for expediting the shipment to its overseas destination. The forwarder takes care of all documentation needed to move the shipment from origin to destination, making up and assembling the necessary documentation for submission to the bank in the exporter's name. The forwarder arranges for cargo insurance, makes the necessary overseas communications, and advises the shipper on overseas requirements of marking and labeling.

Full Container Load, also known as CY. CY is the abbreviation of Container Yard. When the term CY to CY, it means full container load all the way from origin to destination.

In the context of travel activities, gateway refers to a major airport or seaport. Internationally, gateway can also mean the port where customs clearance takes place.

A document required and issued by some national governments authorising the importation of goods.Also referred as import permit. With such documentation, customs clearance can be conducted.

Maintained by the International Chamber of Commerce (ICC), this codification of terms is used in foreign trade contracts to define which parties incur the costs and at what specific point the costs are incurred. (also see incoterm chart)

This certificate is used to assure the consignee that insurance is provided to cover loss of or damage to the cargo while in transit.

Carriers that have both air and ground fleets; or other combinations, such as sea, rail, and truck. Since they usually handle thousands of small parcels an hour, they are less expensive and offer more diverse services than regular carriers.

An intermediate consignee is the bank, forwarding agent, or other intermediary (if any) that acts in a foreign country as an agent for the exporter, the purchaser, or the ultimate consignee, for the purpose of effecting delivery of the export to the ultimate consignee.

An intermediate consignee is the bank, forwarding agent, or other intermediary (if any) that acts in a foreign country as an agent for the exporter, the purchaser, or the ultimate consignee, for the purpose of effecting delivery of the export to the ultimate consignee.

Movement of goods by more than one mode of transport, ie. airplane, truck, railroad and ship.

A letter of credit in which the specified payment is guaranteed by the issuing bank if all terms and conditions are met by the drawee. It is as good as the issuing bank.

An inventory control system that controls material flow into assembly and manufacturing plants by coordinating demand and supply to the point where desired materials arrive just in time for use. An inventory reduction strategy that feeds production lines with products delivered just in time. Developed by the auto industry, it refers to shipping goods in smaller, more frequent lots.

The process of minimizing the times required to source, handle, produce, transport, and deliver products in order to meet customer requirements.

A Japanese term for improvement - continuing improvement involving everyone - managers and workers. In manufacturing, kaizen relates to finding and eliminating waste in machinery, labor, or production methods.

Kan Ban is often seen as a central element of ‘Lean’ manufacturing and is probably the most widely used type of ‘Pull’ signalling system. Kanban stands for Kan- card, Ban- signal and as you probably guessed, is of Japanese origin.S

imply described a ‘pull’ production system controls the flow of work through a factory by only releasing materials into production as the customer demands them i.e. only when they are needed. A ‘push’ system on the other hand would release material into production as customer orders are processed and material becomes available.

A form of cooperative relationship among companies in Japan where the companies largely remain legally and economically independent, even though they work closely in various ways, such as sole sourcing and financial backing. A member of a keiretsu generally owns a limited amount of stock in other member companies. A keiretsu generally forms around a bank and a trading company but distribution (supply chain) keiretsus exist, linking companies from raw material suppliers to retailers.

A measure which is of strategic importance to a company or department. For example, a supply chain flexibility metric is Supplier On-Time Delivery Performance which indicates the percentage of orders that fulfilled on or before the original requested date.

Light assembly of components or parts into defined units, Kitting reduces the need to maintain an inventory of pre-build, completed products, but increases the time and labor consumed at shipment. Lading: The cargo carried in a transportation vehicle.

The sum of the product and transportation costs. The laid-down cost is useful in comparing the total cost of a product shipped from different supply sources to a customer's point of use. Less-Than-Carload (LCL): Shipment that is less than a complete rail car load (lot shipment).

Lean is simply about creating more value for customers by eliminating activities that are considered waste. Any activity or process that consumes resources, adds cost or time without creating value becomes the target for elimination.

A term used when goods do not completely occupy an entire container. When many shipper's goods occupy a single container, each shipper's shipment is considered to be LCL.

Trucking companies that consolidate and transport smaller (less than truckload) shipments of freight utilizing a network of terminals and relay points.

A method of payment for goods in which the buyer established his credit with a local bank, clearly describing the goods to be purchased, the price, the documentation required, and a time limit for completion of the transaction. Upon receipt of documentation, the bank is either paid by the buyer or takes title to the goods themselves and proceeds to transfer funds to the seller.

A data communications network spanning a limited geographical area, usually a few miles at most, providing communications between computers and peripheral devices.

The bill of lading issued by air carriers to their customers.

Broadly, insurance covering loss of, or damage to, goods at sea. Marine insurance typically compensates the owner of merchandise for losses in excess of those which can be legally recovered from the carrier that are sustained from fire, shipwreck, piracy, and various other causes. Three of the most common types of marine insurance coverage are "free of particular average" (f.p.a.), "with average" (w.a.), and "All Risks Coverage."

In order to transport material from one place to another Logistics Managers are using Rail, Road, Air, Water & Pipe Line as the modes of Transportation. A logistics expert need to understand these modes based on priorities, product type. Lead time etc. to decide the appropriate mode of Transportation.

Rail:Used for delivery of a wide range of goods including coal, iron ore, cement, food grains, fertilizers, steel, petroleum products and other heavy goods.

Road:Used by suppliers to deliver goods in a cost effective manner and best suited for short distances. Many transport companies have expertise for fast delivery, packaging etc. for making scheduled delivery.

Air:Used mostly for delivery of high value and tow volume goods from distant suppliers, usually not connected by any other mode of Transportation. It is also suitable for emergent item to be imported for some specific requirement.

Water:Used by firms for delivery of goods from distant suppliers, mostly conducted in containers of varied size. This mode is ideal for transportation of heavy and bulky goods and suitable for products with long lead times.

Pipe Line:Used by oil sector companies for mass movement of Petroleum products including gases. Due to quite low operating cost it is one of the preferred modes of transportation.

The process related to the movement and storage of products from the end of the production line to the end user.

A shipping document issued by shipper to carrier, Customs and consignee serving the purposes of identifying detail information of package count, products count, measurement of each package, weight of each package, etc.

Price and quantity data from the retail location as sales transactions occur.

A poka-yoke (pronounced POH-kah YOH-kay) device is any mechanism that either prevents a mistake from being made or makes the mistake obvious at a glance. Definition by Shigeo Shingo: “The causes of defects lie in worker errors, and defects are the results of neglecting those errors. It follows that mistakes will not turn into defects if worker errors are discovered and eliminated beforehand”.

An invoice provided by a supplier prior to the shipment of merchandise, informing the buyer of the kinds and quantities of goods to be sent, their value, and important specifications (weight, size, and similar characteristics). When an importer applys for Letter of Credit as the means of payment, a Pro Forma Invoice from the beneficiary of such Letter of Credit, usually the exporter, is required by the L/C issuing bank.

Freight paid by the shipper to the carrier when merchandise is tendered for shipment that is not refundable if the merchandise does not arrive at the intended destination.

A carrier that provides transportation service to the firm that owns or leases the vehicles and does not charge a fee. Private motor carriers may haul at a fee for wholly owned subsidiaries.

Private fleets serve the needs of their owners, and do not ordinarily offer commercial trucking services to other customers. Private fleets typically perform distribution or service functions.

This is a term normal referred to when shipping cargo air or sea, which does not fall within standard methods. Ie over-height, or oversize cargo which requires special equipment and handle.

Information supplied by the carrier containing the name of the person who signed for the shipment, the time and date of delivery and other shipment delivery-related information. POD is also sometimes used to refer to the process of printing materials just prior to shipment (Print on Demand).

Communication standards that determine message content and format, enabling uniformity of transmissions.

Public Warehouse: The warehouse space that is rented or leased by an independent business providing a variety of services for a fee or on a contract basis.

The storage of goods by a firm that offers storage service for a fee to the public.

The basic document a public warehouse manager issues as a receipt for the goods a company gives to the warehouse manager. The receipt can be either negotiable or nonnegotiable. Pull Signal: A signal from a using operation that triggers the issue of raw material.

Through Distribution: Supply chain action initiated by the customer. Traditionally, the supply chain was pushed; manufacturers produced goods and pushed them through the supply chain and the customer had no control. In a pull environment, a customer's purchase sends replenishment information back through the supply chain from retailer to distributor to manufacturer so goods are pulled through the supply chain. Pull Ordering System: A system in which each warehouse controls its own shipping requirements by placing individual orders for inventory with the central distribution center. A replenishment system where inventory is "pulled" into the supply chain (or "demand chain" by POS systems, or ECR programs). Associated with "build to order" systems.

The purchaser's authorization used to formalize a purchase transaction with a supplier. The physical form or electronic transaction a buyer uses when placing an order for merchandise.

A pricing structure in which the seller offers a lower price if the buyer purchases a larger quantity.

The process of building product and pushing it into the distribution channel without receiving any information regarding requirements.

A situation in which a firm makes inventory deployment decisions at the central distribution center and ships to its individual warehouses accordingly.

Web casting (push technology) is the prearranged updating of news, weather, or other selected information on a computer user's desktop interface through periodic and generally unobtrusive transmission over the World Wide Web (including the use of the web protocol on intranet). Web casting uses so-called push technology in which the web server ostensibly pushes information to the user rather than waiting until the user specifically requests it.

Removing the material from the dock (or other location of receipt), transporting the material to a storage area, placing that material in a staging area, and then moving it to a specific location and recording the movement and identification of the location where the material has been place.

A pricing structure in which the seller offers a lower price if the buyer purchases a larger quantity.

The process of building product and pushing it into the distribution channel without receiving any information regarding requirements.

A situation in which a firm makes inventory deployment decisions at the central distribution center and ships to its individual warehouses accordingly.

A form of wireless communications that lets users relay information via electromagnetic energy waves from a terminal to a base station which is linked, in turn, to a host computer. The terminal can be placed at a fixed station, mounted on a forklift truck, or carried in a worker's hand. The base station contains a transmitter and receiver for communication with the terminal. RF systems use either narrow-band or spread-spectrum transmissions. Narrow-band data transmissions move along a single limited radio frequency, while spread-spectrum transmissions move across several different frequencies. When combines with a bar code system of identifying inventory items, a radio frequency system can relay data instantly, thus updating inventory records in so-called real time.

The use of radio frequency technology such as RFID tags and tag readers to identify objects. Objects may include virtually anything physical, such as equipment, pallets of stock, or even individual units of product.

Many organizations and individuals have tried to define Reverse Logistics. Since the term is fairly new we refer to the term "reverse logistics" as all activity associated with a product/service after the point of sale, the ultimate goal to optimize or make more efficient aftermarket activity, thus saving money.

Other terms synonymous to Reverse Logistics are Aftermarket Logistics, Retrogistics, or Aftermarket Supply Chain. The reverse supply chain is also a term used in the industry. Reverse Logistics is not to be confused with forward logistics or getting the product to market commonly known as the forward supply chain. Types of activity common with reverse logistics includes: logistics, warehousing, repair, refurbishment, recycling, e-waste, after market call center support, reverse fulfillment, field service and many other.

A type of ship designed to load & discharge cargo which rolls on wheels or tracks.

The letters, numbers or other symbols placed on the outside of cargo to facilitate identification.

Shipping weight represents the gross weight in kilograms of shipments, including the weight of moisture content, wrappings, crates, boxes, and containers (other than cargo vans and similar substantial outer containers).

A Greek letter commonly used to designate the standard deviation of a population.

A term generally used to indicate that a process is well controlled, I.e., tolerance limits are +-6 sigma (3.4 defects per million events) from the centerline in a control chart. The term is usually associated with Motorola which named one of its key operations initiatives Six-Sigma Quality.

A category of unit with a unique combination of form, fit, and function (i.e., unique components held in stock). To illustrate: If two items are indistinguishable to the customer, or if any distinguishing characteristics visible to the customer are not important to the customer so that the customer believes the two items to be the same, these two items are part of the same SKU.

Likely to become a key competitive advantage of selected e-marketplaces. Similar concept to the back-end integration, but with greater emphasis on the moving of goods and services.

An analysis of the strengths, weaknesses, opportunities, and threats of and to an organization. SWOT analysis is useful in developing strategy.

The concept that all supply chain functions are integrated and interact in real time; when changes are made to one area, the effect is automatically reflected throughout the supply chain.

The weight of a container and/or packing materials without the weight of the goods it contains.

A single bill of lading covering receipt of the cargo at the point of origin for delivery to the ultimate consignee, using two or more modes of transportation.

Transshipment refers to the act of sending an exported product through an intermediate country before routing it to the country intended to be its final destination.

TEU is a measure of a ship's cargo-carrying capacity. One TEU measures twenty feet by eight feet by eight feet -- the dimensions of a standard twenty-foot container. An FEU equals two TEUs.

TEU is a measure of a ship's cargo-carrying capacity. One TEU measures twenty feet by eight feet by eight feet -- the dimensions of a standard twenty-foot container. An FEU equals two TEUs.

The ultimate consignee is the person located abroad who is the true party in interest, receiving the export for the designated end-use.

The U.S. Customs Service defines "value for Customs purposes only" as the value submitted on the entry documentation by the importer which may or may not reflect information from the manufacturer but in no way reflects Customs appraisement of the merchandise.

An insurance provision that covers loss due to war and/or strike.

A charge assessed by a pier or dock owner for handling incoming or outgoing cargo.

Parts and subassemblies in the process of becoming completed finished goods. Work in process generally includes all of the material, labor, and overhead charged against a production order which has not been absorbed back into inventory through receipt of completed products.

Referring to operations that are conducted 24 hours a day, 7 days a week, 365 days per year, with no breaks for holidays, etc.

Referring to operations that are conducted 24 hours a day, 7 days a week.

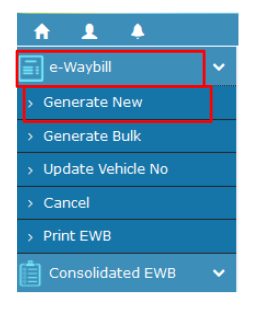

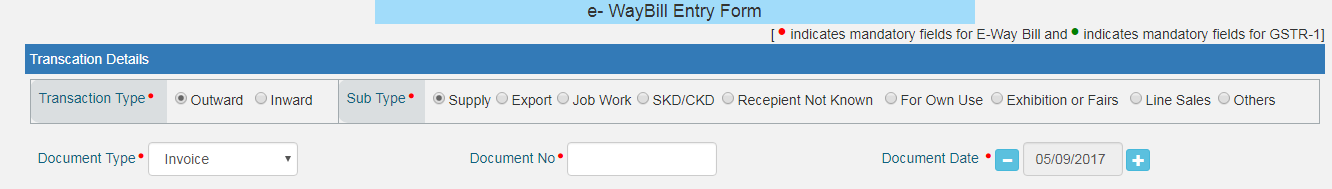

| Who | When | Part | Form |

|---|---|---|---|

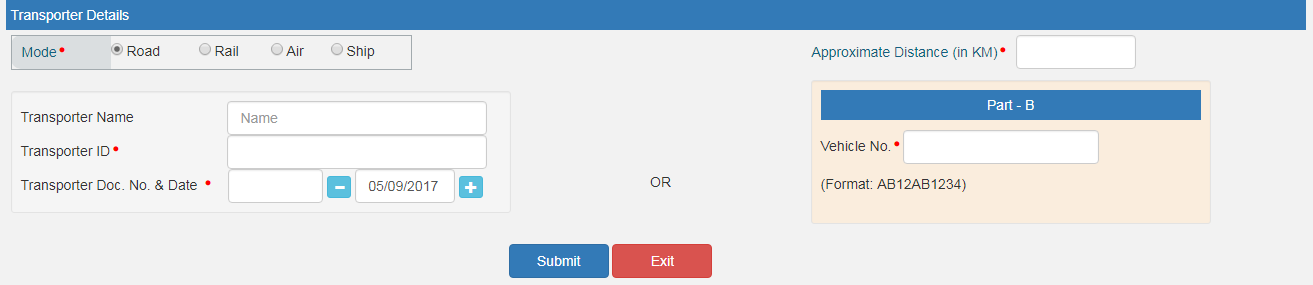

| Every Registered person under GST | Before movement of goods | Fill Part A | Form GST EWB-01 |

| Registered person is consignor or consignee (mode of transport may be owned or hired) OR is recipient of goods | Before movement of goods | Fill Part B | Form GST EWB-01 |

| Registered person is consignor or consignee and goods are handed over to transporter of goods | Before movement of goods | Fill Part B | The registered person shall furnish the information relating to the transporter in Part B of FORM GST EWB-01 |

| Transporter of goods | Before movement of goods | Generate e-way bill on basis of information shared by the registered person in Part A of FORM GST EWB-01 | |

| An unregistered person under GST and recipient is registered | Compliance to be done by Recipient as if he is the Supplier. | Canada | Canada |

| Magazzini Alimentari Riuniti | Giovanni Rovelli | 1. If the goods are transported for a distance of ten kilometers or less, within the same State/Union territory from the place of business of the consignor to the place of business of the transporter for further transportation, the supplier or the | |

| transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01. | |||

| 2. If supply is made by air, ship or railways, then the information in Part A of FORM GST EWB-01 has to be filled in by the consignor or the recipient |

| Distance | Validity of EWB |

|---|---|

| Less Than 100 Kms | 1 Day |

| For every additional 100 Kms or part thereof | additional 1 Day |

|

(Chapter 1-5 ) - Section II-Vegetable Products |

||||||||||||||

|

(Chapter 6-14 ) - Section II-Vegetable Products

|

||||||||||||||

|

(Chapter 15 ) - Section III-Animal or Vegetable Fats and Oils and their cleavage Products; Prepared Edible fats; animal or Vegetable waxes |

||||||||||||||

|

(Chapter 16 -24 ) - Section IV-Prepared Foodstuffs; Beverages, Spirits and Vinegar; Tobacco and Manufactured Tabacco substitutes |

||||||||||||||

|

(Chapter 25 -27 ) - Section V-Mineral Products |

||||||||||||||

|

(Chapter 28 -38 ) - Section VI-Products of the Chemicals or Allied Industries |

||||||||||||||

|

(Chapter 39 - 40 ) - Section VII-Plastics and Articles thereof; Rubber and Articles Thereof

|

||||||||||||||

|

(Chapter 41 - 43 ) - Section VIII-Raw Hides and Skins, Leather, Furskins and Articles thereof; saddlery and Harness; travel goods, Handbags and similar Containers; Articles of animal gut (other than silk-worm Gut) |

||||||||||||||

|

(Chapter 44 -46 ) - Section IX-Wood and Articles of Wood; Wood Charcoal; cork and articles or cork; Manufactures of Straw, of Esparto or of other Plaiting Materials; Basketware and Wickerwork |

||||||||||||||

|

(Chapter 47 -49 ) - Section X-Pulp of wood or of other Fibrous Cellulosic Material; Recovered (Waste and Scrap) Paper or Paperboard; Paper and Paperboard and articles thereof |

||||||||||||||

|

(Chapter 50 -63 ) - Section XI-Textile and Textile Articles |

||||||||||||||

|

(Chapter 64 -67 ) - Section XII-Footwear, Headgear, Umbrellas, Sun Umbrellas, Walking-sticks, seat-sticks, whips, Riding-crops and Parts thereof; Prepared Feathers and articles Made therewith; artificial Flowers; Articles of Human Hair |

||||||||||||||

|

(Chapter 68 -70 ) - Section XIII-Articles of Stone, Plaster, Cement, Asbestos, Mica or similar Materials; Ceramic Products; Glass and Glassware |

||||||||||||||

|

(Chapter 71 ) - Section XIV-Natural or Cultured Pearls, Precious or Semi-Precious Stones, Precious Metals, Metals clad with Precious Metal, and articles thereof; Imitation Jewellery; Coin |

||||||||||||||

|

(Chapter 72 -83 ) - Section XV-Base Metals and Articles of Base Metal |

||||||||||||||

|

(Chapter 84 - 85 ) - Section XVI-Machinery and Mechanical Appliances; Electrical Equipment; Parts thereof; sound Recorders and Reproducers, Television Image and Sound Recorders and reproducers, Television Image and sound Recorders and Reproducers, and Parts and Accessories of such article |

||||||||||||||

|

(Chapter 86 - 89 ) - Section XVII-Vehicles, Aircraft, Vessels and Associated Transport Equipment |

||||||||||||||

|

(Chapter 90 - 92 ) - Section XVIII-Optical, Photographic, Cinematographic, measuring, checking, precision, medical or surgical Instruments and apparatus; clocks and watches; musical instruments; part and accessories thereof |

||||||||||||||

|

(Chapter 93 ) - Section XIX-Arms and Ammunition; Parts and Accessories thereof |

||||||||||||||

|

(Chapter 94 - 96 ) - Section XX-Miscellaneous Manufactured Articles

|

||||||||||||||

|

(Chapter 97 - 98 ) - Section XXI-Works of art, Collectors' Pieces and Antiques |

I’m looking for back to back truckloads alongwith fair and upfront pricing. I prefer timely payment and minimal paperwork. I want to deploy more trucks.

I am looking to start my commission business in transport industry but I don’t have network. I want to associate with a brand which can give me business, trust and timely payments.